cTrader White Label

Full-featured brokerage infrastructureWhat is White Label cTrader?

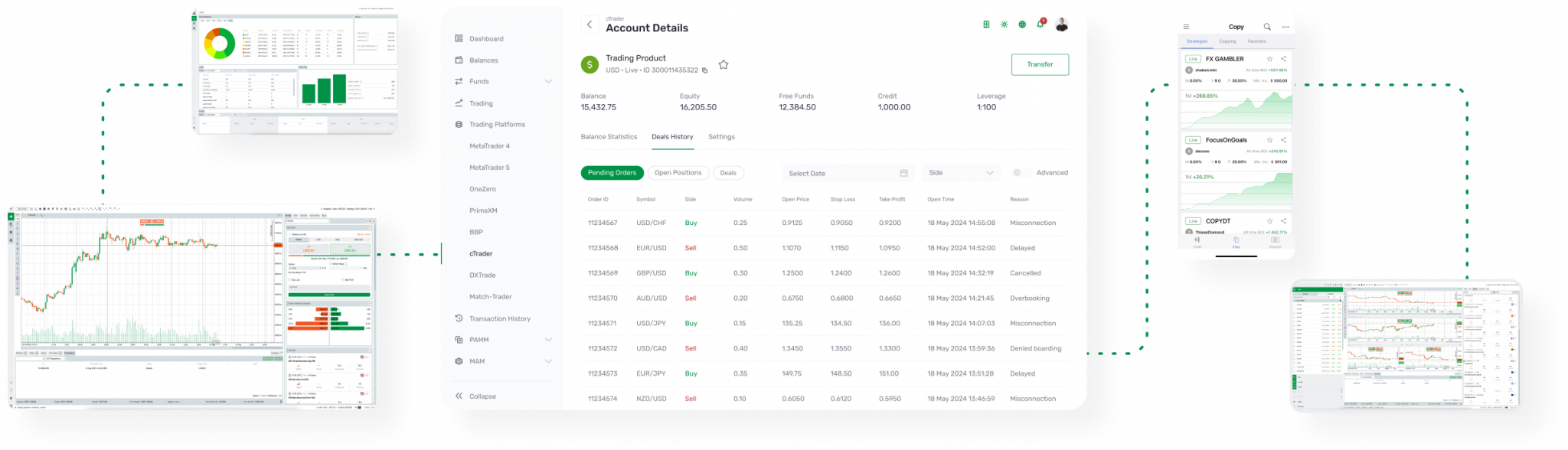

cTrader WL structure

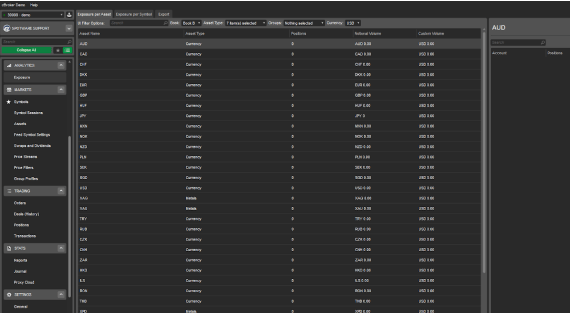

Provide your traders with a wide range of account currency denomination options

Brokers can reduce the potentially catastrophic swings in client equity and their own equity by using multicurrency margin accounts. B2BROKER allows margin accounts to be held in any of the tradable currencies. Margin accounts in multiple currencies can be linked to one another if the clients’ currencies are correlated. A margin account denominated in Bitcoin can work seamlessly with an account denominated in Binance Coin, for instance, with only a small amount of exposure to the volatility variations between the two currencies.

According to margin accounts denominated in the same base currency, the aforementioned example shows full diversification for the base currencies of client groups. Brokers and customers alike will be able to work with the same amount of capital without worrying about the volatility of different currencies.

To guarantee execution for all of his customers in a multicurrency nominated margin account model, a broker must maintain a balance of equity in all of his margin accounts. This means the broker must maintain a larger margin balance in his margin accounts, one that is very close to 100% of customer money, in order to prevent order rejections caused by insufficient capital

The standard brokerage model, where clients share a single margin account denominated in the most commonly used currency. The volatility risk associated with this scheme is minimal when dealing with standard fiat currencies but significantly higher when dealing with cryptocurrencies and other exotic currencies.

Several separate customer groups, each with its own currency, are represented in the illustrative margin account in US dollars shown above. Brokers in this situation will only deal in US dollars, but their clients’ portfolio diversification will drive them to expose themselves to the risk of their clients’ base currencies fluctuating.

A broker who accepts a deposit of 10 Bitcoins from a client would have to keep a margin account balance of 50,000 USD to cover the client’s equity at the current rate of $5,000 per Bitcoin. Using the current exchange rate of 7,000 USD per BTC, the broker would earn 7,000 USD if the client made a profit of 1 BTC. Therefore, the client has 57,000 USD in equity, and the broker has 70,000 USD in equity, as 11 BTC is worth 77,000 USD at the current exchange rate. This disparity will widen noticeably once the price of Bitcoin rises above $10,000 USD.

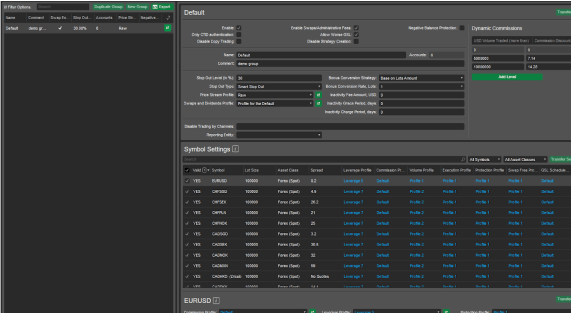

cBroker

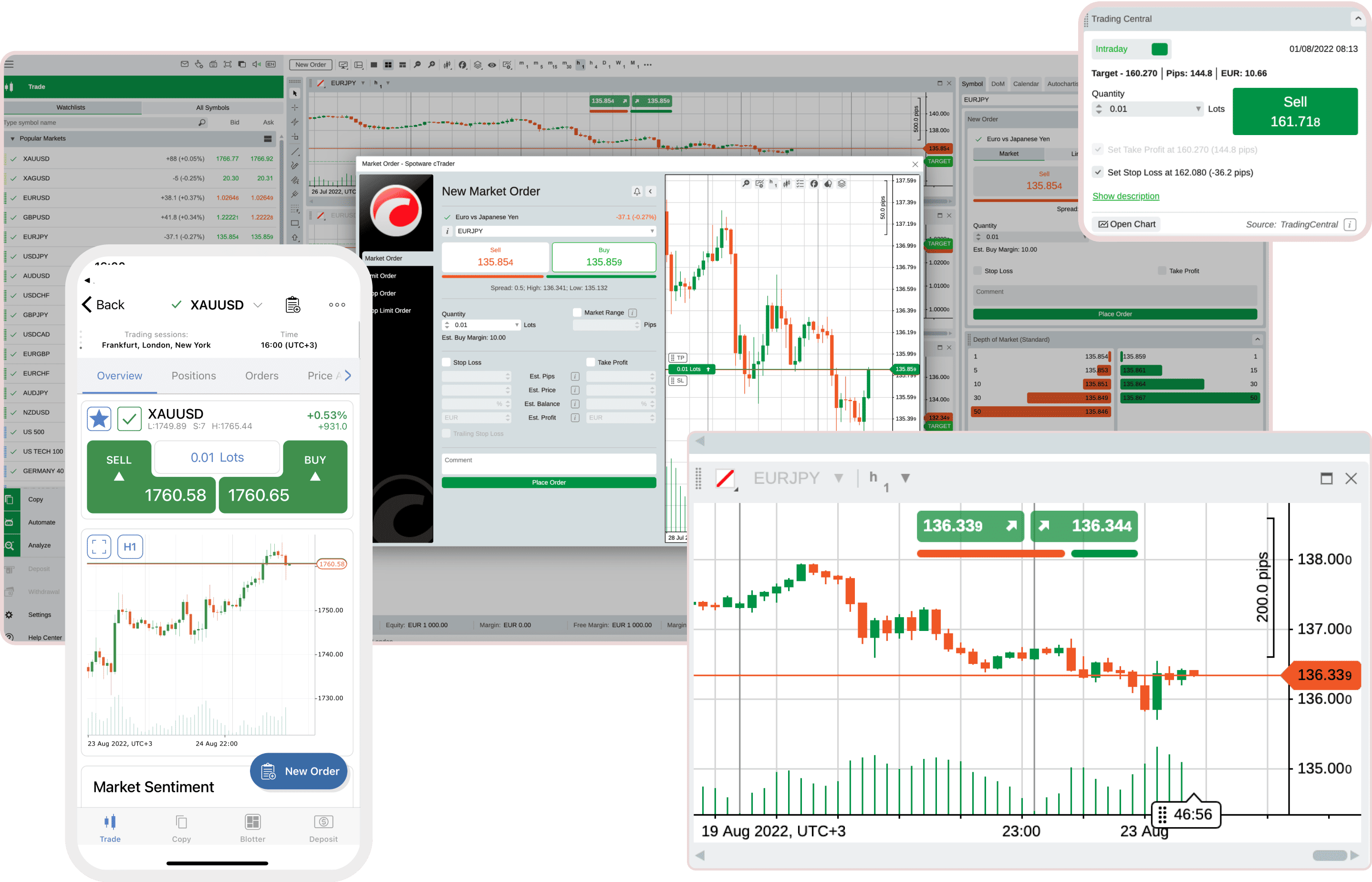

Key features of cTrader

Build your own platform on top of cTrader using open API

Fully branded and customized platform

Key benefits and technical features of the cTrader WL solution

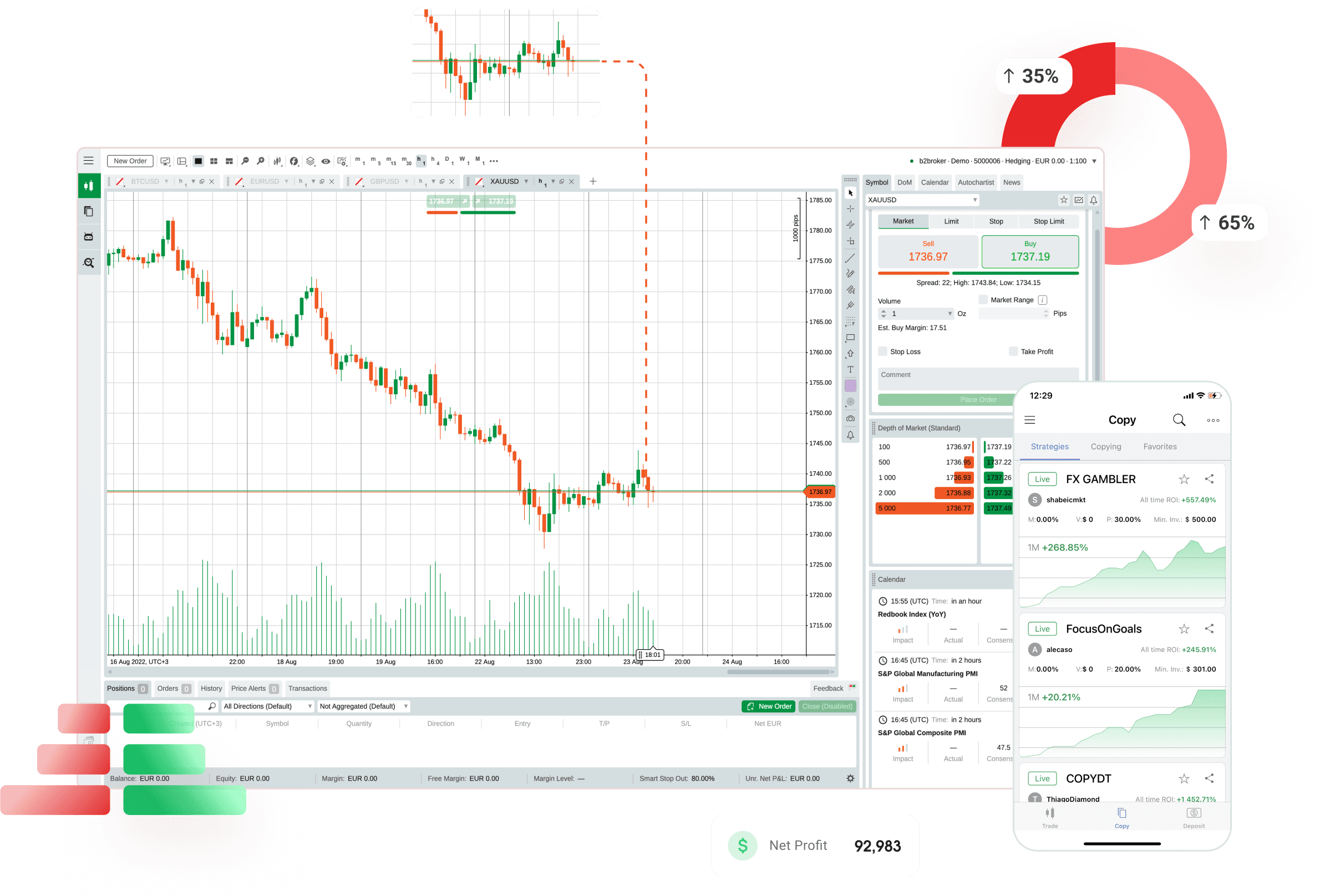

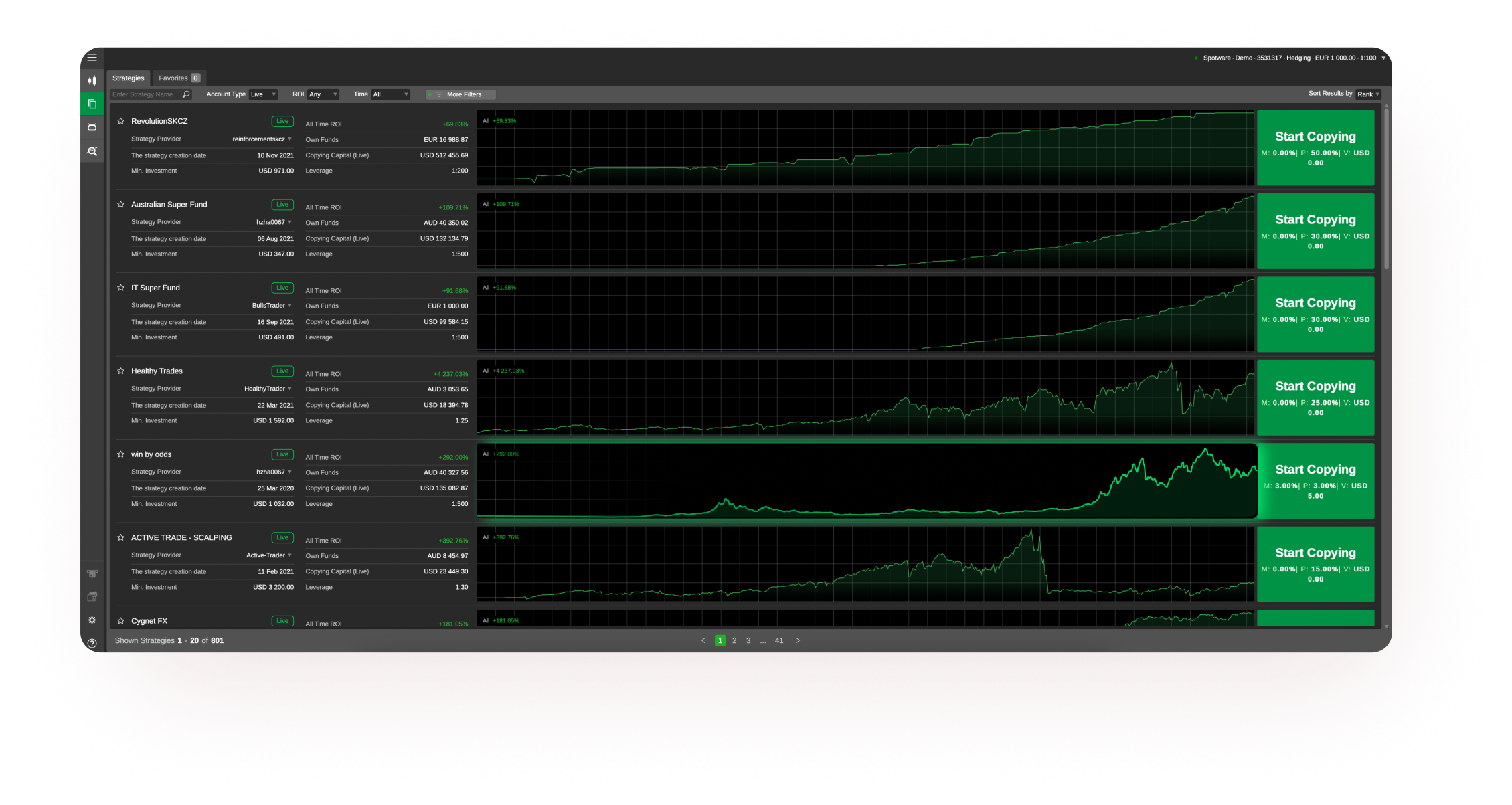

cTrader Copy

Prime of Prime Liquidity Pool

7 asset classes with the most popular instruments from Tier 1 Liquidity. More than 1000 trading instruments are available for FOREX, Metals, Commodities, Indices, Cryptocurrencies, Equities and ETFs.

B2BROKER is a leading liquidity provider because of its stellar reputation, extensive knowledge of the financial markets, and access to cutting-edge tools.

Order types supported by cTrader trading platform

Buying WL cTrader B2BROKER solution vs Getting your own server

What is included

Organization and maintenance of a reliable backup system

Coordinating the upkeep of trade servers and making sure a solid backup plan is in place.

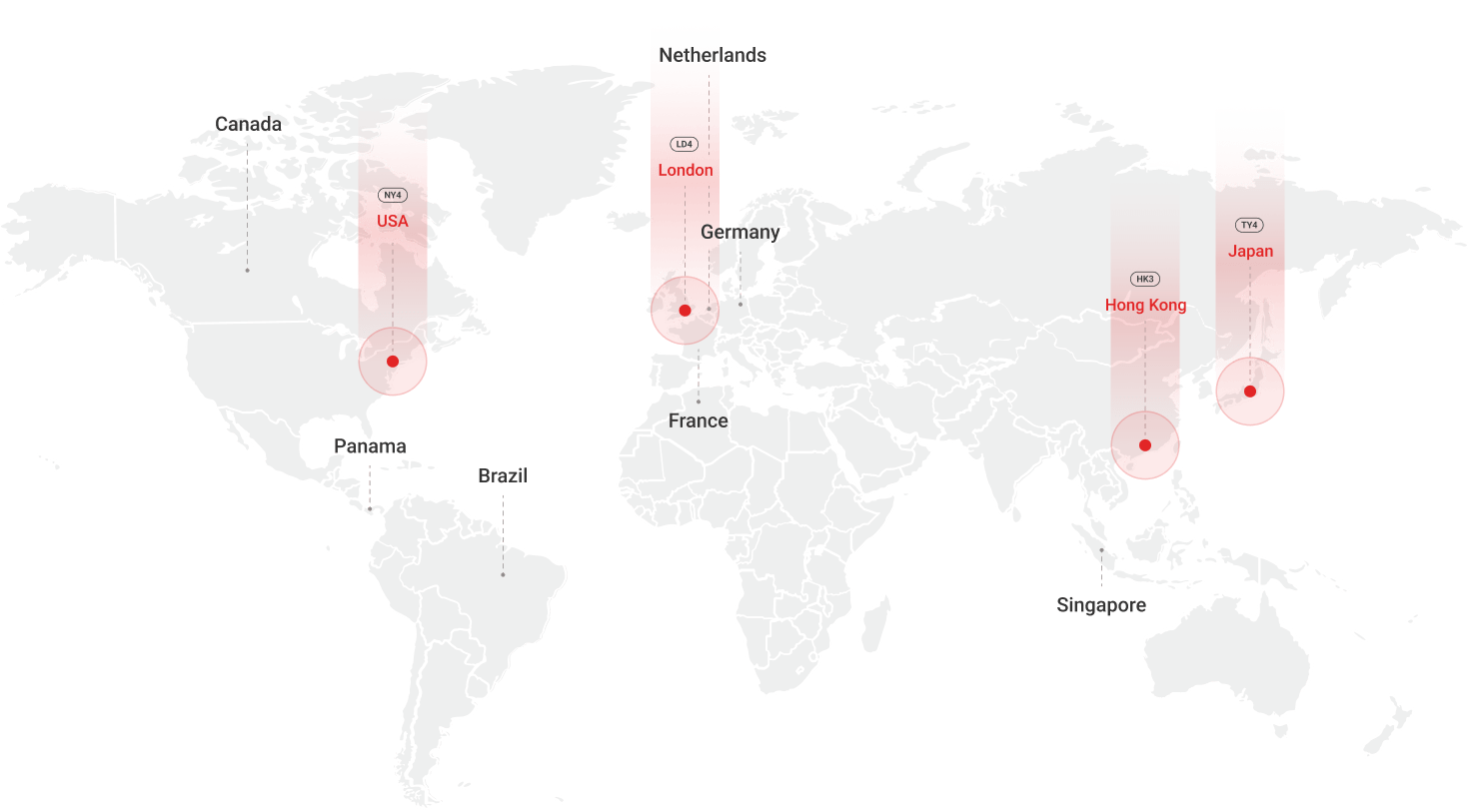

Global access server network

Equinix data centers provide access to our global network, allowing you to tap into the world's greatest financial ecosystem.

Configuration and support of the server structure 24/7

Our team sets up the entire server infrastructure and provides support 24 hours a day, 7 days a week.

Server licenses cTrader

The legalities of server licensing are handled by B2BROKER, so you won't have to worry about it.

Account statements

The WL SMTP server allows for the daily sending of account statements with a specified digital signature.

Strong failover system

cTrader has a strong backup system which is used to build a stable failover service.

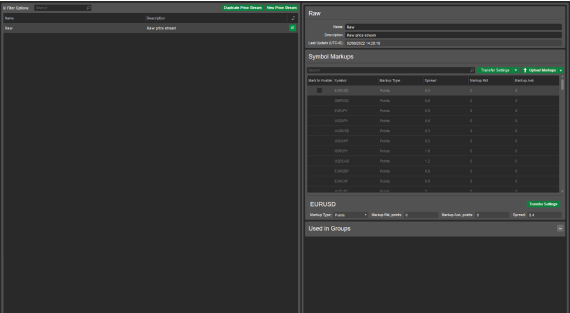

Quotes control mechanisms

Thanks to our liquidity hub solutions we are able to filter out bad quotes and achieve stability of price flow at all times

Liquidity aggregation

Our WL solution comes in with our own liquidity clusters. We aggregate pricing from multiple sources achieving the tightest spreads on the market and rich order book depth

API

Integrations with other systems, such as customer relationship management software and backend systems, can be accomplished with the help of a fully functional API.

Components you need to launch your broker with cTrader WL

Proxy servers all around the world

Trading applications